Intorduction

Aaj ke time me Personal Finance India har kisi ke liye bahut important ho chuka hai. Chahe aap student ho, job karte ho, business owner ho ya homemaker – agar aap apne paise ko sahi tarike se manage nahi karte, toh hamesha financial problems ka saamna karna pad sakta hai.

India me lakhon log mehnat se earn toh karte hain, lekin proper financial planning na hone ki wajah se na to saving kar paate hain aur na hi investment. Isi liye personal finance ke basic rules samajhna bahut zaroori hai.

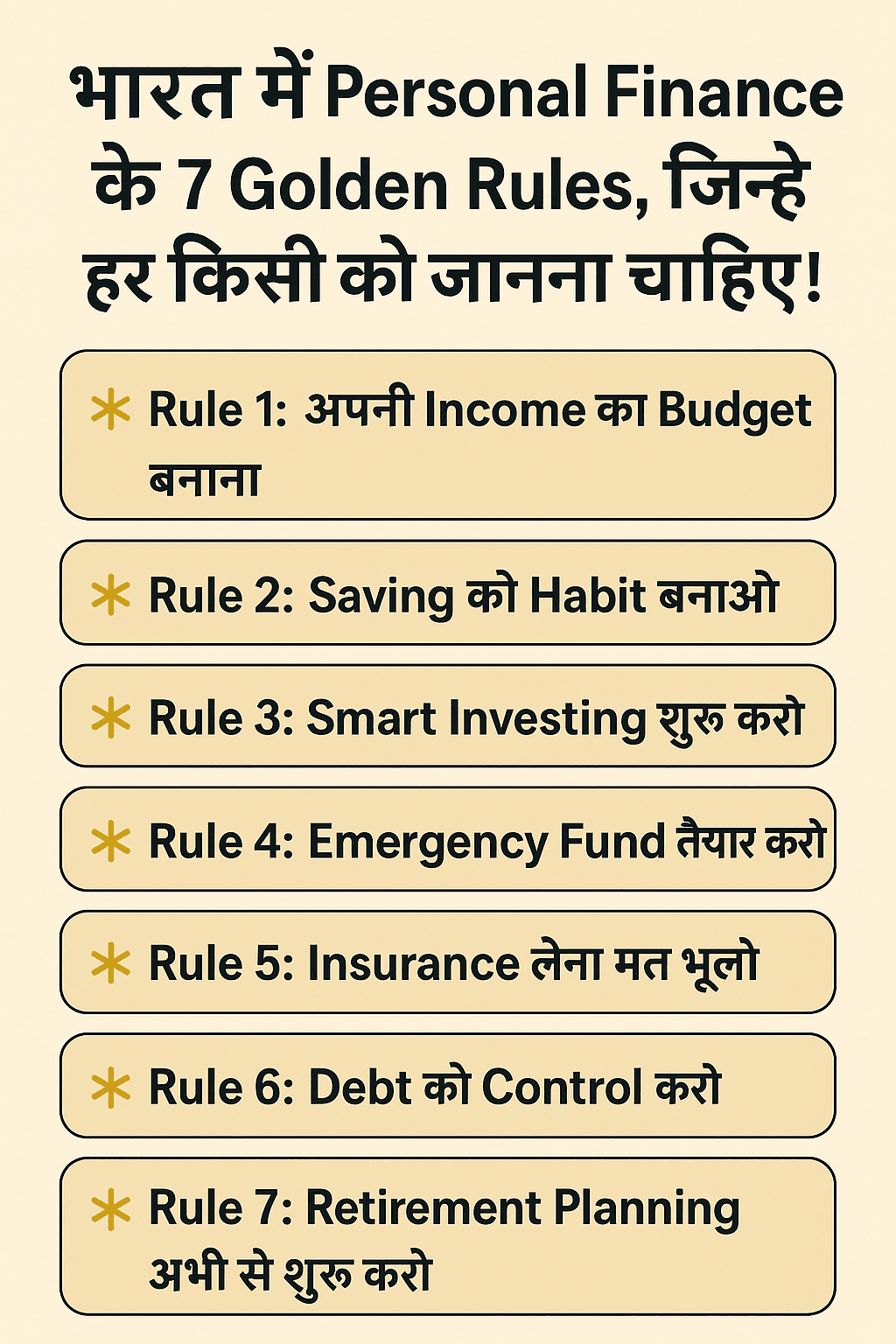

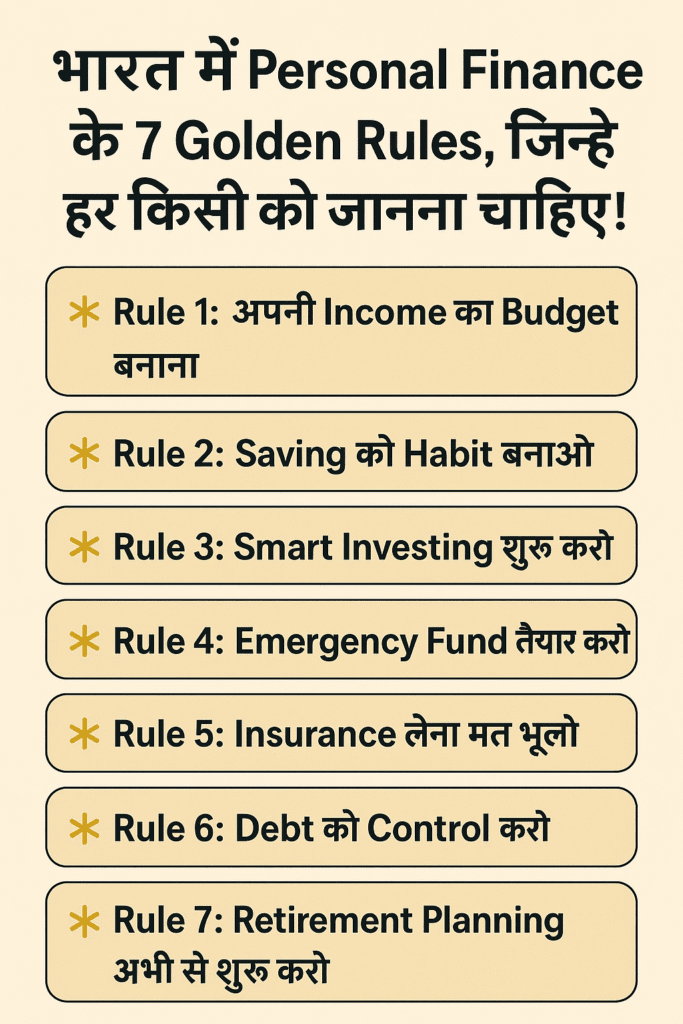

Is blog me hum baat karenge Personal Finance ke 7 Golden Rules, jinko follow karke aap financial tension kam kar sakte ho aur Financial Freedom ki taraf bada step le sakte ho.

Rule 1: Apni Income ka Budget Banao

Agar aap budget nahi banate toh mahine ke end tak paisa khatam ho jaata hai. Budget banana personal finance ka pehla aur sabse important step hai.

Best way hai 50-30-20 Rule follow karna:

- 50% – Zaroori kharche (Ghar, khana, bills, travel)

- 30% – Lifestyle (shopping, hobbies, entertainment, travel)

- 20% – Saving aur Investment

Example: Agar aapki monthly income ₹30,000 hai toh ₹15,000 zaroori kharche par, ₹9,000 lifestyle par aur ₹6,000 saving/investment par lagna chahiye.

Rule 2: Saving ko Habit Banao

Saving sirf old generation ke liye nahi hai – aaj ke youth ke liye bhi utni hi zaroori hai. Golden rule hai – Save before you spend.

- Salary aate hi kam se kam 20% saving account, FD ya RD me daal do.

- Auto-debit laga do taki saving skip na ho.

- Chhoti-chhoti luxury (daily bahar khana, impulsive shopping) avoid karke badi saving ho sakti hai.

Rule 3: Smart Investing Start Karo

Saving sirf pehla step hai. Asli growth Investment se hoti hai. Agar aap paisa sirf bank account me rakhte ho, toh inflation uski value kam kar dega.

Smart Investment Options:

- Mutual Funds (SIP) – Small amount se start karo, compounding ka fayda milega.

- PPF (Public Provident Fund) – Long-term aur safe option.

- NPS (National Pension Scheme) – Retirement ke liye best.

- Stock Market – Thoda knowledge lekar long-term invest karo.

Rule 4: Emergency Fund Ready Karo

Life uncertain hai – job loss, medical emergency ya koi unexpected expense aa sakta hai. Isliye ek Emergency Fund hona bahut zaroori hai.

Rule: Kam se kam 6 months ki salary ek alag savings account ya liquid fund me rakho.

Example: Agar aapki salary ₹25,000 hai toh kam se kam ₹1.5 lakh ka emergency fund hona chahiye.

Rule 5: Insurance Lena Mat Bhulo

Insurance koi extra kharcha nahi, balki family ke liye financial security hai.

- Health Insurance – Medical expenses se bachata hai.

- Term Insurance – Aapke hone ke baad bhi family ko support deta hai.

Dhyan rahe – Insurance ko investment mat samjho, iska main kaam protection hai.

Rule 6: Debt ko Control Karo

India me bohot log credit card aur personal loans ka misuse karte hain. High-interest loans savings ko khatam kar dete hain.

Golden Rules:

- Sirf utna hi loan lo jitna easily repay kar pao.

- Pehle high-interest debt (jaise credit card) clear karo.

- EMI burden avoid karne ki koshish karo.

Rule 7: Retirement Planning Abhi Start Karo

Retirement planning ke liye 40s ka wait mat karo. Jitna jaldi start karoge, utna zyada benefit milega.

Best Options:

- NPS (National Pension Scheme) – Tax benefits + pension security.

- PPF – Safe aur long-term.

- Mutual Funds SIP – Long-term wealth creation ke liye best.

Power of Compounding: Agar aap 25 saal ki age me sirf ₹5,000 per month invest karna start karte ho, toh 60 saal ki age tak easily crore+ wealth bana sakte ho.

Conclusion

Doston, yeh the India me Personal Finance ke 7 Golden Rules:

- Budget banao

- Saving habit banao

- Smart investing karo

- Emergency fund rakho

- Insurance lo

- Debt control karo

- Retirement planning karo

Agar aap in rules ko follow karte ho, toh aap apne present ko secure kar paoge aur future ko financially strong bana paoge.

Yaad rakhiye – Personal Finance sirf rich logon ke liye nahi hai, balki har common man ke liye equally important hai.

Aaj se hi chhote steps lo aur apne sapno ki taraf financial freedom achieve karna start karo.